Wisconsin Divorce Lawyers

Our divorce attorneys are well-equipped to help you navigate divorce in Wisconsin

When you’re facing a divorce, separation, or custody battle, you’re facing an emotional and difficult time for yourself and for your family. Even when you and your spouse are on the same page, a divorce is never easy. You’re in an emotional place, and you’re struggling to get the fair treatment you need for yourself and your children. It can be exhausting, and if you’re fighting back alone, your case may not end fairly.

Wisconsin Divorce Information

Our divorce lawyers at Karp & Iancu understand how difficult a divorce or even a separation can be, and we’ll help you get the fair treatment you deserve.

Divorce Timeline

Get a better understanding of a typical Wisconsin divorce timeline here.

Timeline of DivorceDivorce FAQs

Answers to your questions about divorce in Wisconsin that we hear all the time.

WI Divorce FAQsGrounds for Divorce in Wisconsin

Wisconsin is a no-fault divorce state. This means you don’t need a specific reason for a divorce, and only one spouse needs to be able to testify under oath that the marriage is irretrievably broken. Read more about grounds for divorce here.

Some common reasons for divorce include:

- Marital & spousal incompatibility

- Extramarital relations & affairs

- Verbal or physical aggression

- Emotional or physical abuse

- Workaholism

- Confinement in prison

- Ongoing mental health issues

Divorce & Your Kids

The best interests of your children are the court's primary concern when dealing with child-based family law cases. This includes things like: adequate time with both parents, money to support children, and a safe and healthy home to grow up in. Learn more about these topic areas below.

Child Custody & Visitation

Learn whether sole custody or joint custody is best for your children and find a visitation schedule that will work for your family.

More about child custodyChild Relocation

Do you have questions about where you can relocate your children in the state of Wisconsin? We can help you understand the laws surrounding relocating a child.

More about child relocationChild Support

When you’re a parent going through a divorce, your first concern is likely your children. Our lawyers are experts in guiding clients through the options available. We understand your top priority is making sure your children are taken care of.

More about child supportWhat’s Next?

Dealing with a family dispute can be tough, whether that’s a separation or divorce, and it can be even worse when things have gotten violent. It can be confusing and complex, and it can feel like you’re not getting the help and attention you need during this difficult time.

Our Wisconsin divorce attorneys can help you get the property you deserve and the best situation for your children. Your rights should be protected, and we can make sure that those rights are respected.

How to set up a no-pressure, no cost attorney consultation

Reach out to us today by giving us a call or by booking a consultation to set up a confidential, one-hour consultation with one of our family law attorneys.

Learn more about our divorce attorneys

When evaluating and deciding on the right family law attorney, it’s important to find one who is transparent, compassionate, and knowledgeable; traits that all of our attorneys value.

Types of Divorce in Wisconsin

Schedule a strategy session for a transparent and custom quote for your case

Wisconsin divorce rate statistics

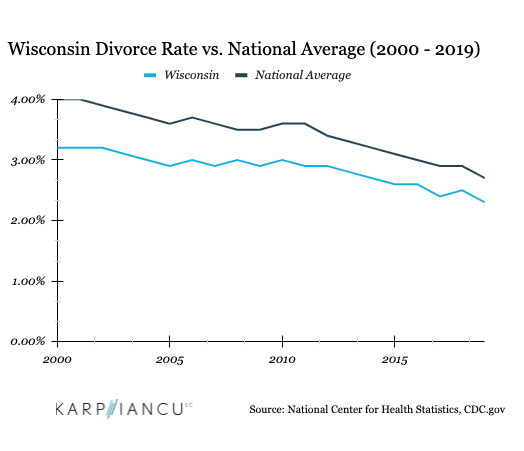

Divorce rate in Wisconsin vs. National average (2000-2019) via CDC.gov

According to the CDC, the divorce rate in Wisconsin has been below the national average since 2000. While the rate of divorce has been decreasing nationwide, including Wisconsin, since 2000, your unique situation is more than a statistic. This is why Karp & Iancu’s family law and divorce practice is founded on compassion, fairness, and thorough representation.

Meet our award-winning Wisconsin family law attorneys.

Divorce Alternatives

Sometime divorce isn't the best path to reach your goals. Here are some alternatives to divorce in Wisconsin.

Legal Separation

An alternative to divorce that still allows you to define your rights to your children and finances while claiming your independence.

More about legal separationAnnulment

A legal annulment is a legal procedure for declaring a marriage null and void from the inception.

More about annulmentFamily Law Offices

933 N. Mayfair Rd., Suite 300

Milwaukee, WI 53226

Hours

M – F: 6:30am – 8pm

Sa – Su: 7:30am – 6pm

See our reviews

See our reviews